2025 will be a favorable year for major banks

Overview of the U.S. Banking Industry in 2025

Article Reference:

Why 2025 Could Be a Great Year for Big Banks (Source: Wall Street Journal+) By Jon Sindreu

Fed Policy Impact on Banks

The Fed recently indicated that due to higher-than-expected inflation, there might only be two rate cuts in the coming year, triggering a brief sell-off in US stocks. However, rates "staying higher for longer" is actually good news for the banking sector, especially large full-service lending institutions.

According to latest signs, 2025 could become a year of broad recovery in banking operations, covering areas including lending, trading, and underwriting.

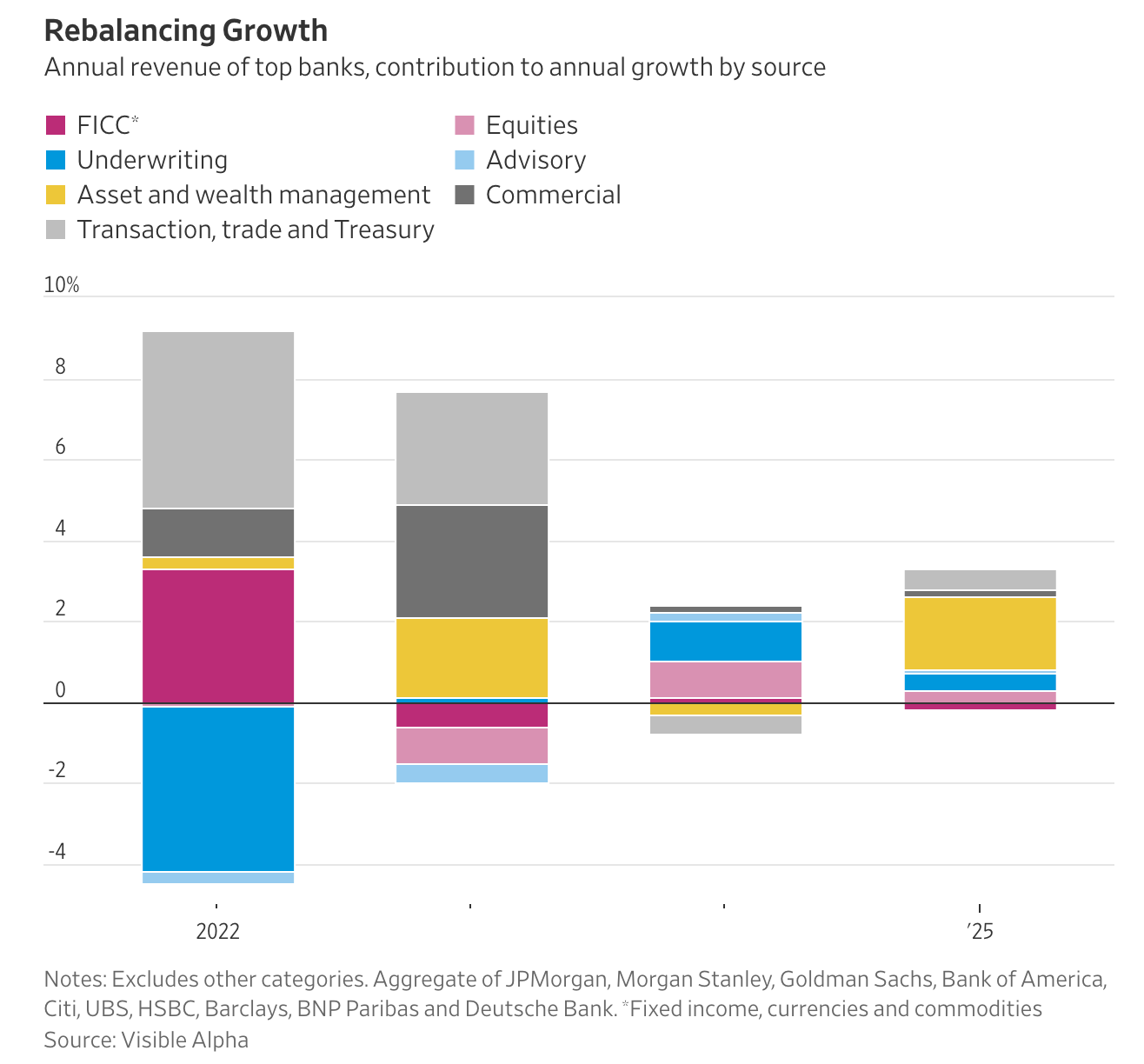

In 2022, as global trade quickly rebounded after stagnating during severe pandemic periods, trading intermediaries like Citigroup (C) and HSBC saw sales surge. Client flow significantly increased at fixed income, currency and commodities (FICC) trading desks, as Russia's full invasion of Ukraine and rate tightening cycle drove hedging demands for interest rates, foreign exchange and energy prices. Large banks like JPMorgan (JPM) and Deutsche Bank (DBK) benefited significantly.

2023 marked an important turning point for banking. After spreads widened, banks finally earned more from the gap between higher rates paid by borrowers and deposit rates. However, high borrowing costs plus ongoing economic and geopolitical uncertainties led to significant decline in trading volumes, pressuring banks' investment banking business.

However, negative impacts from geopolitical and economic uncertainties were equally significant, causing companies to delay stock and bond issuance, significantly reducing underwriting fees and suppressing these institutions' capital markets revenue growth.

2025 Banking Industry Recovery Outlook

According to latest signs, 2025 is expected to be a year of broad recovery in banking operations, covering key areas including lending, trading and underwriting. As rate policy stabilizes and the economy gradually adapts to a high-rate environment, market demand for financial services will significantly rebound. Especially in fixed income and energy trading areas, growth in underwriting business and trading volume is expected to bring an optimistic outlook for large lending banks.

Core drivers of banking recovery come from multiple factors, including interest rate environment stabilization, rising attractiveness of fixed income products and potential energy market activity. Additionally, corporate financing demands will gradually release, supporting comprehensive capital market business growth. For banks, these momentum will make 2025 a key year for profit growth, bringing new opportunities and confidence to investors.

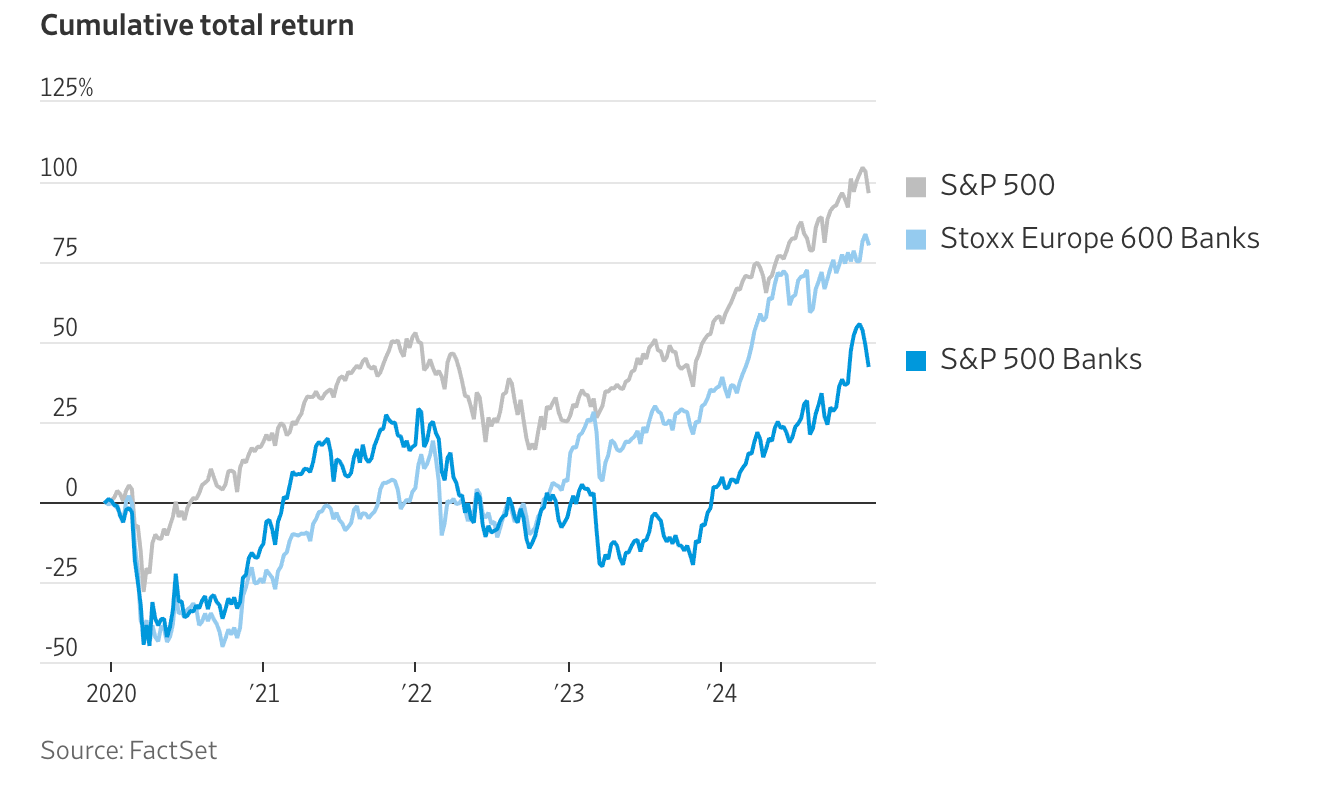

Cumulative Total Return Comparison: Divergence in Performance between US Market, Banking Sector and European Banks

1. The banking sector is heavily influenced by economic cycles, showing higher volatility especially during the early pandemic period and in high interest rate environments

2. The 2024 rebound shows the banking sector benefiting from an improved interest rate environment, but total returns still lag behind the overall market.

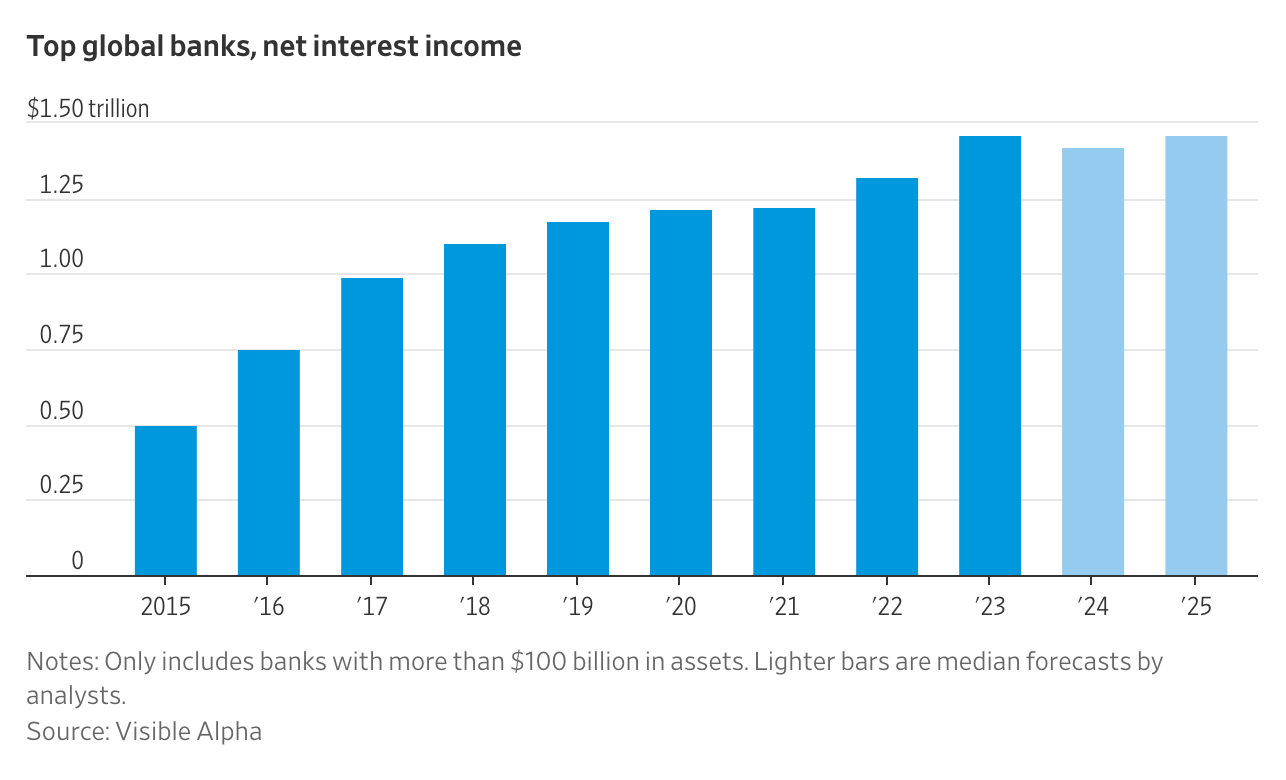

Global Bank Net Interest Income Reaching Peak, Growth Expected in 2025

1. Interest Rate Impact on Net Interest Income:

As major global economies implemented multiple rate hikes between 2021 and 2023, banks' net interest income significantly increased, as loan rates typically rise faster than deposit rates.

The slowdown in growth from 2024 to 2025 reflects weakening marginal effects on net interest income growth after rates approach peak.

2. Asset Size and Growth Stability:

Large banks with assets over $100 billion typically have higher stability, maintaining net interest income growth even during economic fluctuations, demonstrating their market position and scale advantages.

3. Risk Factors:

If economic recession occurs, decreased loan demand and repayment ability may lead to reduced net interest income.

Credit Quality: Rising bad debt rates may offset income growth brought by interest rate increases.

4. Long-term Outlook:

With development of digitalization and business diversification, banks may reduce reliance on traditional interest income, seeking more fee and non-interest income.

Bank Revenue Focus Shift: From Fixed Income to Wealth Management

In 2025, all revenue sources will be more balanced, with large banks achieving business diversification and reducing dependence on single business lines.

Looking Forward to Steady Growth in Bank Net Interest Income in 2025

Analysis:

1. Interest Rate Impact on Net Interest Income:

During multiple rate hikes by major global economies from 2021 to 2023, banks' net interest income significantly increased as loan rates typically rise faster than deposit rates.

The growth slowdown from 2024 to 2025 reflects weakening marginal effects on net interest income growth after rates approach peak.

2. Asset Size and Growth Stability:

Large banks with assets over $100 billion typically have higher stability, maintaining net interest income growth even during economic fluctuations, demonstrating their market position and scale advantages.

3. Risk Factors:

In economic recession, decreased loan demand and repayment ability may reduce net interest income.

Credit Quality: Rising bad debt rates may offset income growth from interest rate increases.

4. Long-term Outlook:

With digitalization and business diversification development, banks may reduce reliance on traditional interest income, seeking more fee and non-interest income.

2025 Banking Industry Profit Growth Drivers:

1. Steep Yield Curve Helps Banks Expand Interest Spread

Steep yield curve particularly benefits banking operations (banks earn more easily when gap between short-term and long-term rates widens) by helping expand Net Interest Margin (NIM), enhancing bank profitability.

Bank Profit Logic:

Banks pay deposit interest using short-term rates (cost) and lend or invest using long-term rates (income).

If long-term rates are much higher than short-term rates, banks can earn larger interest spreads, increasing profits.

When short-term bond yields are lower than long-term bond yields (steepening yield curve), this typically positively impacts banks' earning ability. This is because banks can attract deposits at lower short-term rates (e.g., paying deposit interest) and lend at higher long-term rates (e.g., mortgages or business loans). This widening of interest rate spread (net interest margin, NIM) is one of banks' main profit sources, so yield curve steepening often directly improves banks' core business earnings.

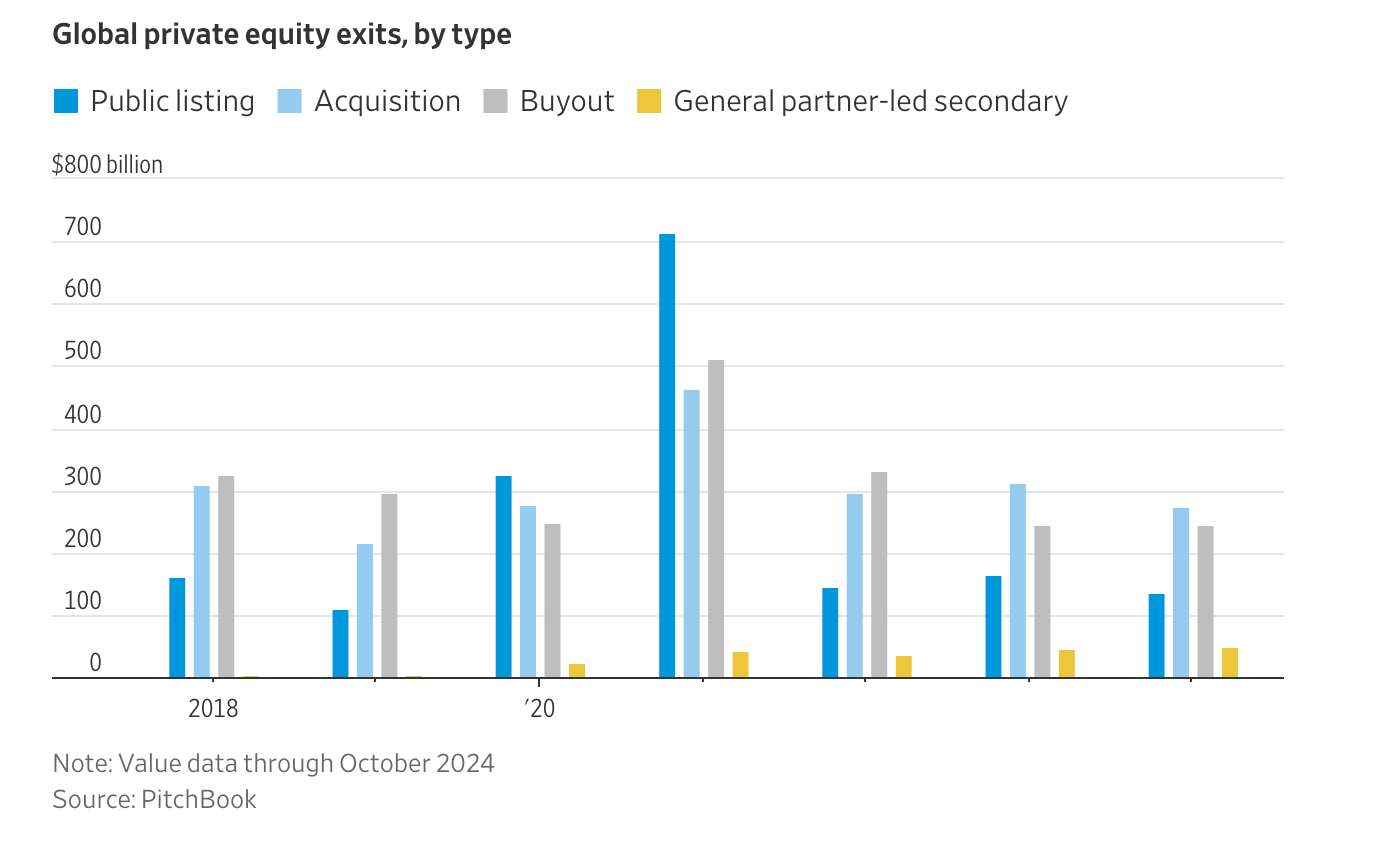

2. Strong Recovery in Advisory Business in 2025

2025 is expected to be a prosperous year for advisory business. As private equity funds continue facing exit pressure, transaction activity in this field will significantly rebound. According to Bain & Company estimates, by the end of 2024, about 46% of private equity fund holdings will have exceeded 4-year holding periods, indicating more exit and transaction demands. Although fund sponsors try extending investment cycles through strategies like transferring assets to "continuation funds," overall market exit pressure is accumulating and will drive advisory business demand recovery.

3. New Government's Policy Support May Provide Additional Boost for Banks

If the Trump administration relaxes regulatory scrutiny of the financial sector and M&A activities, the banking industry will receive additional policy tailwinds. This will especially benefit large investment banks like Goldman Sachs (GS), helping them excel in M&A and capital markets areas. Such policy environment improvements may further stimulate banks' business performance in 2025.

4. Revenue Diversification Helps Banking Sector Become Market Recovery Pillar

As the market environment stabilizes, revenue source diversification (including wealth management and US IPO financial services) will strengthen the banking industry's position in global financial markets. From fixed income trading to high-yield advisory services, synchronized recovery across business segments brings strong return prospects for investors.

Conclusion: Positive Banking Industry Outlook for 2025

With yield curve steepening, increasing private equity fund exit pressure, and potential regulatory loosening, banking industry is expected to welcome multiple positive factors in 2025, driving comprehensive growth in trading, lending and advisory businesses, creating sustained return momentum for investors.

Analyst predictions show global top banks are expected to achieve revenue growth across all business divisions except FICC (Fixed Income, Currency and Commodities) trading for the first time since 2021.

Visible Alpha data indicates that as interest rate trends gradually stabilize, banking business recovery will cover areas including consumer lending, investment banking services and wealth management, injecting new growth momentum into the banking sector in 2025.